owe state taxes california

Other things being equal your corporation will owe California corporate income tax in the. Of all the states that levy a state income tax only a handful exclude unemployment benefits and California is one of them.

I Owe California Ca State Taxes And Can T Pay What Do I Do

In California the lowest tax bracket is.

. I have a rental property in Utah I live in California and Im worried about what taxes both state and federal that Ill owe on it. 5110 cents per gallon of regular. Taxes are not the same in each state they are calculated differently.

Extensions of time to file tax returns. See if you Qualify for IRS Fresh Start Request Online. If you qualify for the California Earned Income Tax Credit EITC 7.

Federal tax brackets go from 10 for incomes between 10000 and 19999 to 37 for those earning more than 523600. You can get up to 3027. We have been living in Nevada for 3 yrs but owe state taxes in California My husbands income is the only.

The State of California Franchise Tax Board is the state. If you had money. Some taxpayers instantly qualify.

Pay the amount you owe by April 18 2022 to avoid penalties and interest. WASHINGTON Taxpayers requesting an extension will have until Monday Oct. Your 2019 State Tax Withholding was lower than 2018.

There are also states that apply no income tax but they still have ways to collect money. For the latest tax year your California corporation had taxable net income of 100000. An extension to file your tax return is not an extension to pay.

Use Payment for Automatic Extension. 9 rows California state tax rates are 1 2 4 6 8 93 103 113 and 123. A 1 mental.

2015 is the first full year that Im renting it out. California State Tax Quick Facts. Ad Owe back tax 10K-200K.

You didnt defer or you deferred. Federal income tax still applies. How much you owe.

If you do not owe taxes or have to file you may be able to get a refund. 073 average effective rate. Owe back state taxes in California can they garnish Nevada wages.

Owe IRS 10K-110K Back Taxes Check Eligibility. In rare cases the Franchise Tax Board will consider an Offer In Compromise a rare but way of actually paying less than you owe. Below are additional reasons why you may owe state income tax compared to last year.

Why Does California Have Some Of The Highest State Income Tax And State Sales Tax In The Country Quora

Understanding California S Sales Tax

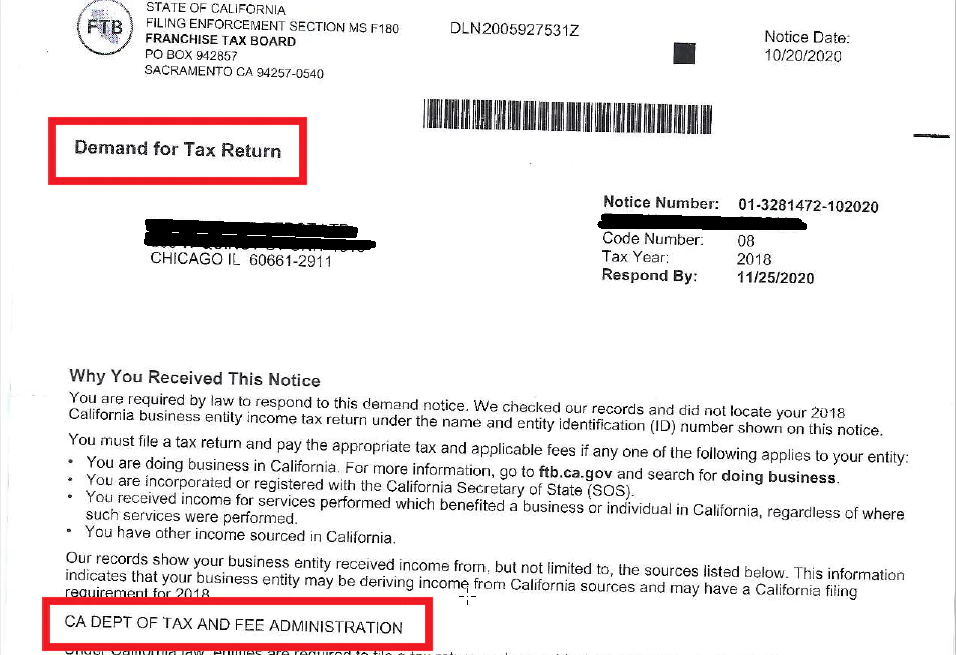

Handling A Ca Franchise Tax Board Ftb Demand Letter For Out Of State Online Sellers Capforge

Understanding California S Property Taxes

California Wealth And Exit Tax Would Be An Unconstitutional Disaster Foundation National Taxpayers Union

California Use Tax Information

Federal And State Tax Payment Deadlines Extended To July 15 The Santa Barbara Independent

California Ftb Rjs Law Tax Attorney San Diego

California S Tax System A Primer

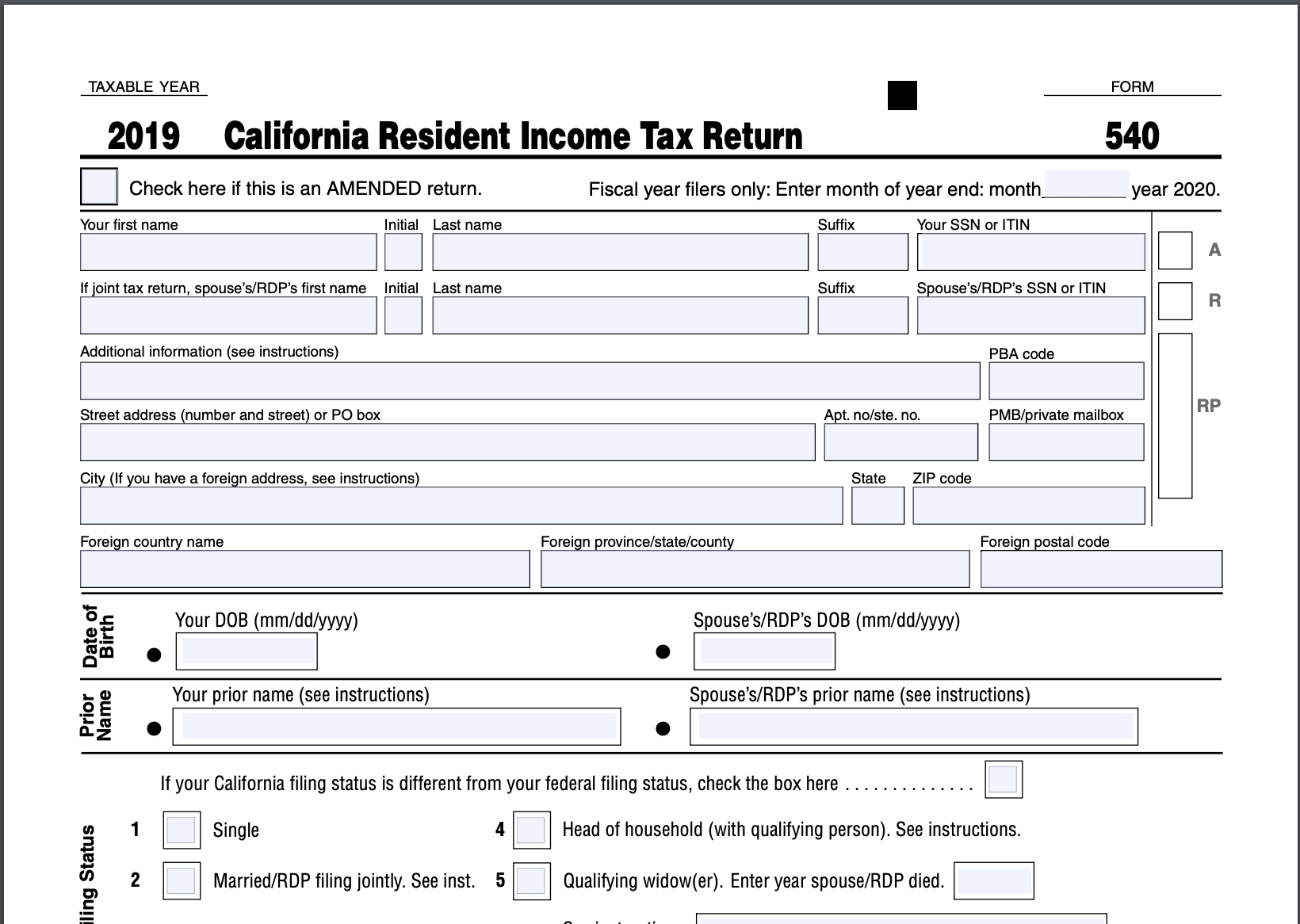

Irs Form 540 California Resident Income Tax Return

What Are California S Income Tax Brackets Rjs Law Tax Attorney

2021 Personal Income Tax Booklet California Forms Instructions 540 Ftb Ca Gov

Understanding California S Sales Tax

Irs Form 540 California Resident Income Tax Return

Determining California Taxes For Expats

Scv News Lookup Table To Help When Filling Out California Income Tax Return Scvnews Com

The Limits Of Nudging Why Can T California Get People To Take Free Money Planet Money Npr